Welcome To The UAE, The Hub For Doing Business.

Kick-Start Your New Business With Rubik.

Safest City – Dubai being one of the safest cities to live in, it is the right place to settle and

do all your business transactions..

0% Tax – For all the transactions you make, it is just 0% tax on the capital gain. No matter in which part of the world you do business, you can always invoice from your UAE based company and make transactions through your UAE based bank account.

No limit – And there are no restrictions on your capital gain.

When you exchange any kind of goods over any platform in exchange for money, then it is a trading business. You are not allowed to do any business in the UAE, without being licensed.

Yes there are many people who sell online without a proper license. Using social media is free but you are not supposed to do any business without a proper license issued from the licensing authority in the UAE. You can be charged a penalty of AED 25,000 for doing so.

Considering the fact of growing E-commerce business owners and many people doing business without a proper license, the licensing authority has reduced the license cost by almost 65%. Now you can do business legally by getting a license for just AED 5,500. Why take a risk when you can be licensed at such a low budget.

Import & Export – If you are involved in import and Export in any part of the world, you can have a UAE Freezone license. You can invoice from your UAE based company and all transactions can be done through the UAE bank account.

Wholesale Business inside the UAE – If you are involved in a wholesale business, where you just import the goods from any part of the world and sell it in the UAE as wholesale. In this case Freezone license is the perfect solution.

No retail – If you are not involved in a retail business, where you do not sell directly to the end users, then Freezone is the perfect place to register your business. However, you can sell your products to end users through any online platform.

Get Licensed – First and the foremost thing is to get an E-commerce license from any registration authority in the UAE.

Customs Registration – Your company will be eligible to register at customs so that you can import goods from outside the UAE.

Import goods – You can import goods from anywhere in the world. There is no limitation for the amount of goods you bring in.

What Goods Can you import – The only restricted products are Tobacco, Alcohol, and illegal products. Apart from these, you can import any goods which you are licensed for.

Which Port to use for shipping – Your goods can arrive in any port in the UAE. It can be via sea or air freight.

Store anywhere in the UAE – You can store your goods anywhere in the UAE. It doesn’t matter from which Emirate the license is issued, you can still store it anywhere in the UAE.

VAT Payment – All goods that you import will be subjected to 5% VAT payment. The VAT is exempted in freezone like JAFZA, DWC, DAFZA. These are the premium freezone and the cost of business set-up is very high. The cost can Start from AED 38,000.

Customs Duty – Most of the goods have a customs duty of 5%. It can vary for some goods

Have a warehouse – There are a lot of licensed warehouses which will provide you the storage space. You can have a contract for any size and any time period. And this storage can be anywhere in the UAE.

Buy goods from Local Market – You are free to buy any goods from the local market and then sell it within the UAE or export it to other countries. It is completely legal to do so.

Do Re-Export – You can import goods from any part of the world and re-export it to other countries. You can either store it in the UAE and Re Export after a while or Re-Export without getting it out of the port.

VAT & Customs Duty on Re-Export – There is no VAT or customs duty applicable for those goods which are re-exported.

Sell anywhere in the UAE – Being licensed from any freezone in the UAE, you can sell anywhere in the UAE. People from any corner of the UAE can place an order and you can deliver it to them. This will be purely a wholesale business.

Invoice under your company – All goods that you purchase can be invoiced under your license. Once you have your TRN you can claim the VAT that you paid while purchasing.

Residence Visa – Your trading company will be eligible to sponsor visas for the shareholders and the employees. You should choose the license package accordingly

Bank Account – Yes, you will be eligible to get a bank account in the UAE.

VAT Registration – Your company will be eligible to register to VAT only after you cross a turnover of AED 200,000 and the TRN will be issued for your business. It is mandatory to register before you cross a turnover of AED 360,000 annually.

Commercial Trading License – You can be licensed for specific goods or products. For example; Garments Trading, Electronics Trading, Food stuff trading etc. Each of these are individual activities. The freezone in the UAE allows you to choose between 3-5 different activities in one license. You are allowed to do business only on those activities mentioned in your business license.

General Trading License – A general trading license gives you a complete freedom to do the trading business on any type of goods. The only restricted products are Pharmaceutical drugs, Tobacco products, Alcohol, Precious metals and Automobiles.

Freezone License – You can set-up your business in the Freezone jurisdiction. Sharjah Freezone is the lowest cost business set-up in the UAE. However you can get a license from DUbai Freezone too. Dubai Freezone license will be a bit costlier compared to SHarjah freezone.

No NOC required – Anyone can register a trading business in the UAE Freezone. No matter what kind of residency you have. Employment visa, Family visa, Investor visa, a tourist visa or even when you are outside the UAE without any visa, you can still register a trading business in the UAE Freezone..

Trade name reservation – Your proposed company name should be available to register for your business. Our experts can check the availability and confirm if the name meets all the requirements of the Trade name guidelines.

Documents required – Passport copy, passport size photo, Copy of existing Visa, Mobile number, Email ID and Residential address. Residential address and Mobile number can be of within the UAE or outside the UAE.

Process Time – It can take upto 2 days to register your trading business in the UAE Freezone.

What activities are allowed – Sharjah Freezone allows you to choose any three activities in your license. It can be General Trading + E-Commerce + any services related. We always suggest you stick to your business. It will be difficult to get a bank account when you have a different line of business in one license.

Rubik is a channel partner with all the Freezones in the UAE. It is the same as if you are directly dealing with the Freezone. The only difference is that we are here anytime for anything you need in the UAE.

Whether you’re just a beginner or an expert, Rubik has reliable and custom made plans for you to start your E-commerce business successfully.

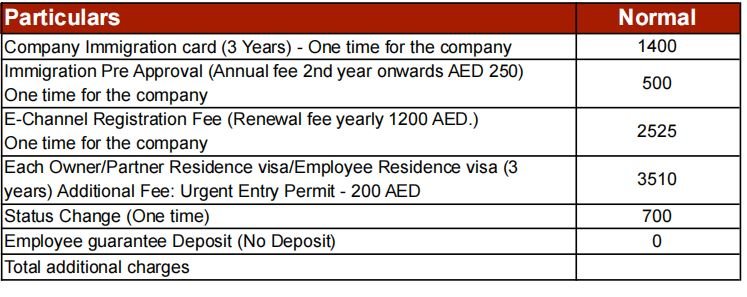

When you need just a business

license.

License renewal every year at AED 7,000

● Trading license with 5 trading activities,

● Special activities will cost AED 2,500 additional.

● Option to have an E- commerce activity

● Lease agreement for virtual office

● Share certificate and MOA

For those who need complete set-up.

Save AED 4,000

Normally AED 18,000

License renewal every year at AED 6,500

● Trading license with 5 trading activities,

● Special activities will cost AED 2,500 additional.

● Option to have an E -commerce activity.

● Lease agreement for virtual office

● Share certificate and MOA

● Guaranteed Bank Account

With added benefits

Save AED 4,000

Normally AED 20,000

License renewalevery year at AED 6,500

● Trading license with 5 trading activities,

● Special activities will cost AED 2,500 additional.

● Option to have an E-commerce activity

● Lease agreement for virtual office

● Share certificate and MOA

● Guaranteed Bank Account

● Customs Registration

● Develop a website

● Free Domain – 1 year

● Free Microsoft Office 365 – 30 days